Vegas Dave

Not a Real GameLiver

- Since

- Jan 28, 2010

- Messages

- 4,176

- Score

- 2,191

- Tokens

- 20

Stevey you famously hate crypto scammers, you cant marry one just because she's hot 😂Id marry her

Stevey you famously hate crypto scammers, you cant marry one just because she's hot 😂Id marry her

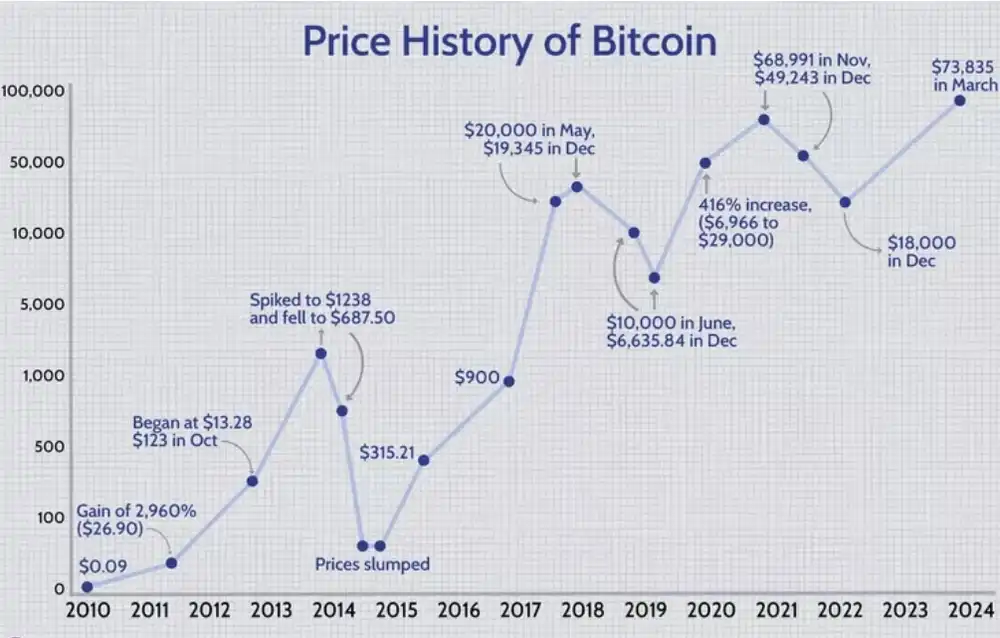

You don’t have to like it. To each his own.Under 54k on Sept 7, over 72k now. Currency of the future for sure, very stable!

It works for me, though, as a store of value.

It works for me, though, as a store of value.

It works for you as magical fairydust that keeps going up, more like.You don’t have to like it. To each his own.It works for me, though, as a store of value.

View attachment 11946

I jumped into Bitcoin 6 months ago. Never thought I would. After learning how to use it, it’s actually pretty cool.It works for you as magical fairydust that keeps going up, more like.

And hey, more power to you and other holders 👍. As long as ya'll keep pretending it has worth, it does.

I agree, the tech behind it is really cool.I jumped into Bitcoin 6 months ago. Never thought I would. After learning how to use it, it’s actually pretty cool.

The rise in it over that time is a nice side effect

$72k 🔷 🚀We might hit $71K today, boys

Great stats Boner. I would’ve thought Bitcoin was up more than that.BTC up only 16% over the last three years while the S&P is up 26% over the same period with approx 1.5% annual dividend yield. A diversified (aka less risky) basket of assets that absolutely crushes the yield AND creates a positive cash flow... I'll stick with actual stores of value, thanks.

S&P companies may be industry leaders in products and services, but they aren't on the BLOCKCHAIN Bone BoneI'm exploiting a quirk and cherry picking from the last BTC spike (fall of 2021). Most other periods BTC beats the S&P by a fair amount... though never enough for me to speculate in it, slow and steady for me. Maybe 5% of my funds go to lotto tickets like BTC.

why are you assuming I don’t, for example, have most of my money in VOO and ROTH IRA?BTC up only 16% over the last three years while the S&P is up 26% over the same period with approx 1.5% annual dividend yield. A diversified (aka less risky) basket of assets that absolutely crushes the yield AND creates a positive cash flow... I'll stick with actual stores of value, thanks.