CASPERWAIT$

Drama Moobs Your Mom

- Since

- Aug 3, 2010

- Messages

- 13,683

- Score

- 3,024

- Tokens

- 0

Okay so presently at $20 an hour (with Newsom trying to raise it another 3.5%) it got me thinking.

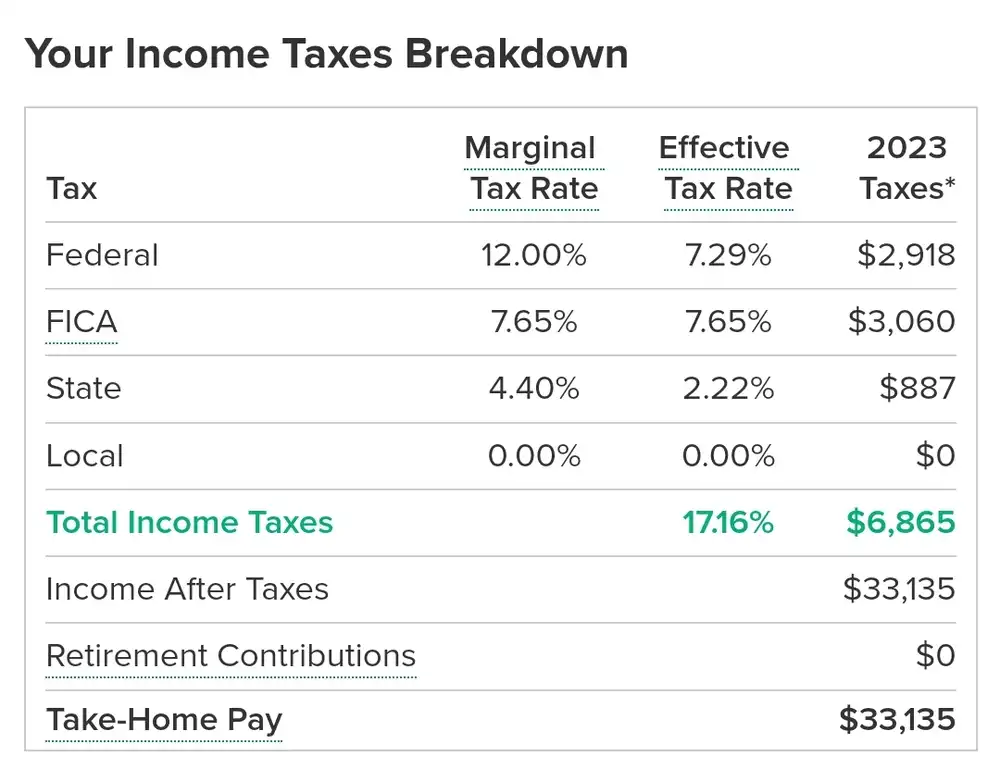

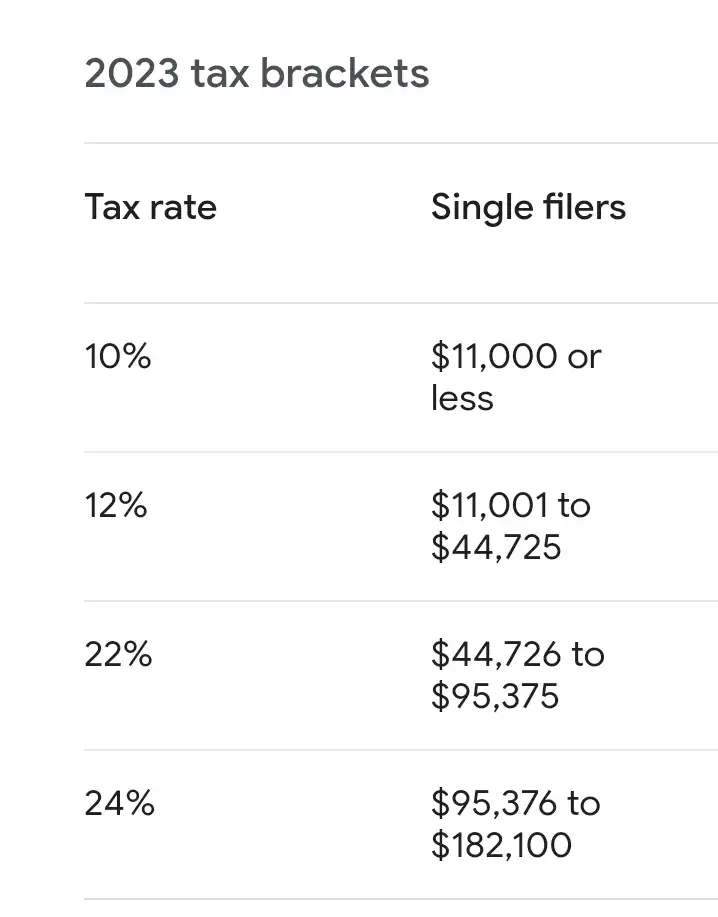

So you work 40 hours a week. $800 earned before taxes. At 30% taken out of your check you’re left with $560. Multiply that by 4 weeks and you’re making $2240 a month take home. Now they say for rent you should pay 30% of your take home income. That gives you $672 a month for rent. Now the average rent in California is $1837 a month. Even with another fast food roommate, that’s still only $1344 towards rent. Essentially you need to work 50 hours a week at McDonalds and have a roommate to live.

That actually isn’t bad to be honest. It’s a reasonable way to live.

Maybe @stevek and I should go work at McDonalds and get a place together in California 🧐

So you work 40 hours a week. $800 earned before taxes. At 30% taken out of your check you’re left with $560. Multiply that by 4 weeks and you’re making $2240 a month take home. Now they say for rent you should pay 30% of your take home income. That gives you $672 a month for rent. Now the average rent in California is $1837 a month. Even with another fast food roommate, that’s still only $1344 towards rent. Essentially you need to work 50 hours a week at McDonalds and have a roommate to live.

That actually isn’t bad to be honest. It’s a reasonable way to live.

Maybe @stevek and I should go work at McDonalds and get a place together in California 🧐